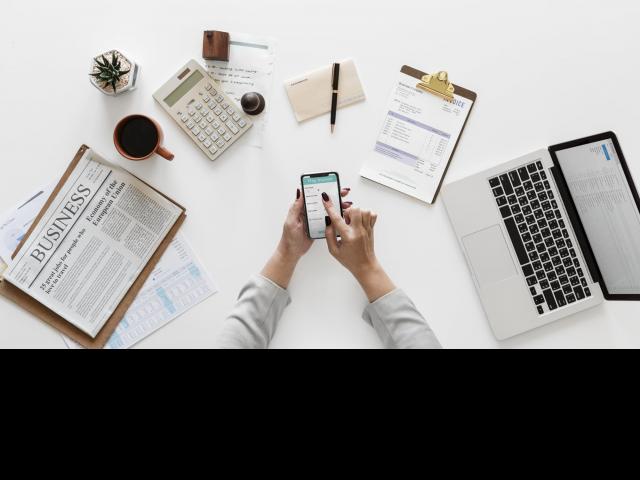

Local business, though full of energy as well as fresh concepts, oftentimes do not have the ideal framework as well as enough fund to keep their organisation running efficiently and to execute the brand-new company concepts. Realities like absence of suitable software service, specialist email-service, as well as the price problems related to modern technology infrastructure maintenance etc. Office 365 is an ingenious technology solution that fits the business needs of the small businesses the very best! It supplies anywhere accessibility to your company at no extra price for setting up the IT infrastructure. The suite additionally offers business-class devices as well as safety at a budget friendly price. The solutions which belong to the Office 365 Small Company Costs, supply anywhere accessibility to email, documents, and solutions and are constantly maintained to day. The collection is easy to establish and take care of without any IT experience. What’s so special regarding the Workplace 365 is that the attributes of Office 365 are genuinely mobile. Office Internet Applications, which are part of the Office 365, are currently boosted to provide you with the full function experience in your web browser, to ensure that you can create new documents or edit using your favorite browser. Additionally, one also gets updated editing performance like inline respond to remarks in addition to rich editing experience. They can organize and join reliable on the internet conferences with multi-party HD video clip, material sharing, as well as real-time note taking. This will certainly offer an extra side to the local business to depict their specialist picture among their clients. Not simply that! Office 365 additionally provides the stipulation to develop a specialist internet visibility with your very own domain name and also Design. You can additionally publish, as well as update your business website without the aid of a web developer. Can you request even more?!

Yes! You can. In addition to this you likewise get expert e-mail service in addition to calendar as well as differed mail as well as record themes. Now, that’s Workplace 365 Small Business Costs from you.